In at present's financial landscape, entry to credit score is crucial for a lot of individuals dealing with unexpected expenses or financial emergencies. Traditional lenders often rely heavily on credit scores to find out eligibility for loans, which may depart those with poor or no credit histories in a troublesome place. In response to this want, 0 credit check loans have emerged in its place financing possibility. This report explores the nature of 0 credit check loans, their benefits, potential drawbacks, and issues for borrowers.

What are 0 Credit Check Loans?

0 credit check loans are monetary products that allow borrowers to obtain funds with out undergoing a credit check. Because of this lenders don't assess the borrower's credit score history or score as part of the appliance course of. As an alternative, these loans are often primarily based on alternative standards, similar to revenue verification, employment standing, or bank account data.

These loans can are available varied varieties, including personal loans, payday loans, and installment loans. The terms and circumstances can vary extensively relying on the lender and the precise loan product.

Forms of 0 Credit Check Loans

- Payday Loans:

- These are quick-time period loans typically due on the borrower's subsequent payday. They are often for small amounts, designed to cover immediate money needs. While they do not require credit score checks, they normally include excessive-interest rates and charges.

- Title Loans:

- Title loans permit borrowers to make use of their car as collateral. The lender holds the title to the vehicle till the

instant loan approval no credit check is repaid. These loans also often carry excessive-interest charges but can provide bigger sums of money compared to payday loans.

- Installment Loans:

- Some lenders offer installment loans with out credit checks, permitting borrowers to repay the loan in fastened installments over a set interval. These loans may be for bigger amounts and should have more manageable repayment terms than payday

private loans no credit check.

- Personal Loans from Different Lenders:

- Certain on-line lenders and financial expertise corporations offer personal loans without credit score checks, relying instead on different knowledge to assess creditworthiness.

Benefits of 0 Credit Check Loans

- Accessibility:

- The primary benefit of 0 credit check loans is accessibility. Individuals with poor credit score or no credit historical past can nonetheless obtain financing, making it an attractive possibility for those in urgent want of funds.

- Fast Approval and Funding:

- These loans often function expedited utility processes, with many lenders offering fast approvals and identical-day funding. This speed will be essential in emergency conditions.

- Flexible Eligibility Necessities:

- Since lenders don't rely on credit scores, the eligibility standards could be more flexible. Borrowers could qualify based mostly on earnings, employment, or other elements that display their capacity to repay the loan.

- No Affect on Credit Rating:

- Because these loans don't contain credit score checks, making use of for one does not affect the borrower’s credit score rating. This can be useful for those looking to avoid additional damage to their credit profile.

Drawbacks of 0 Credit Check Loans

- Excessive-Interest Rates:

- One of many most important drawbacks of 0 credit check loans is the excessive-interest rates and charges related to them. Lenders typically compensate for the increased threat of lending to individuals with poor credit score by charging exorbitant rates.

- Short Repayment Phrases:

- Many of these loans come with quick repayment periods, which can result in financial strain if borrowers are unable to repay the loan on time. This can lead to extra fees or the need to take out another loan to cowl the unique debt.

- Danger of Debt Cycle:

- Borrowers could discover themselves trapped in a cycle of debt, where they regularly take out new loans to pay off previous ones. This can result in a worsening financial situation and increased reliance on high-value loans.

- Limited Loan Amounts:

- 0 credit check loans often have decrease most loan quantities compared to traditional loans, which is probably not enough for bigger bills or emergencies.

Considerations for Borrowers

Earlier than pursuing a 0 credit check loan, borrowers ought to fastidiously consider the next:

- Assess Your Monetary State of affairs:

- Perceive your present monetary situation, together with earnings, bills, and ability to repay the loan. Solely borrow what you possibly can afford to repay.

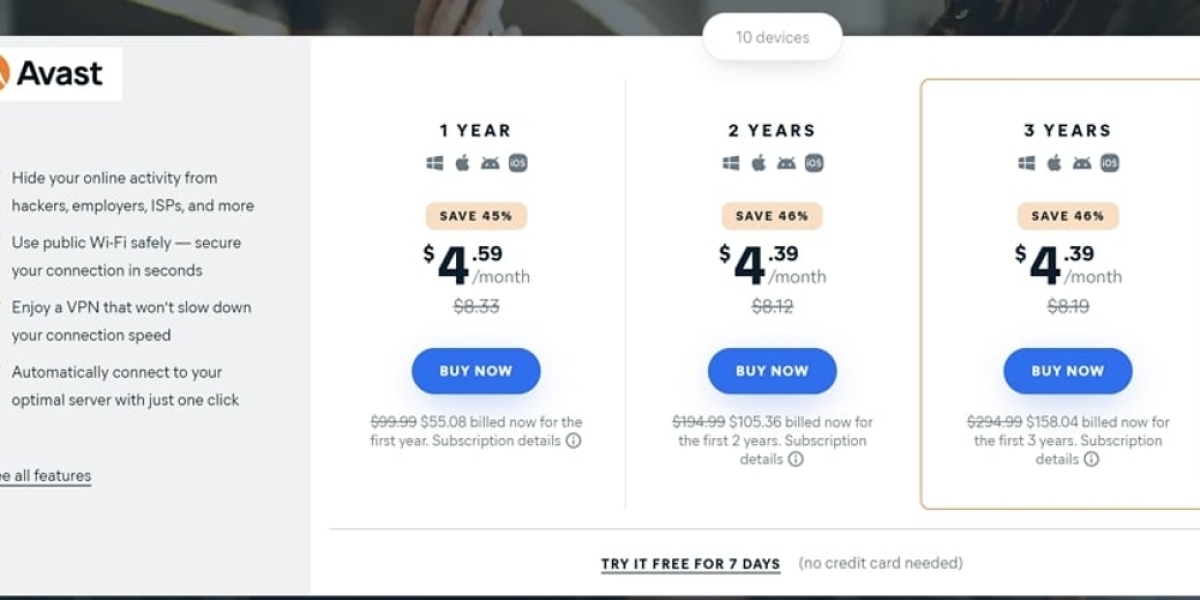

- Analysis Lenders:

- Not all lenders are created equal. It is crucial to research and compare totally different lenders, their terms, curiosity charges, and customer reviews to seek out a good supply of funding.

- Learn the Fine Print:

- Always learn the loan settlement fastidiously. Be aware of all fees, curiosity rates, and repayment phrases before signing.

- Explore Options:

- Consider different options for borrowing, such as credit unions or

peer-to-peer lending platforms, which can offer more favorable phrases. Moreover, exploring personal loans from conventional banks or credit score unions might yield better rates if you have any credit historical past.

- Plan for Repayment:

- Have a transparent repayment plan in place earlier than taking out the loan. Consider how you will make payments and ensure that you won't have to depend on further loans to fulfill your obligations.

Conclusion

0 credit check loans (Main Page) can present a valuable resource for individuals going through financial emergencies or unexpected expenses. While they offer accessibility and fast funding, borrowers have to be cautious of the excessive-curiosity rates and potential debt cycles related to these loans. By totally understanding the phrases and conditions, researching lenders, and contemplating alternative options, borrowers could make informed choices that align with their monetary wants. Ultimately, accountable borrowing and a transparent repayment technique are important to navigating the challenges of 0 credit check loans successfully.