"Executive Summary Contactless Payment Market Size and Share Across Top Segments

"Executive Summary Contactless Payment Market Size and Share Across Top Segments

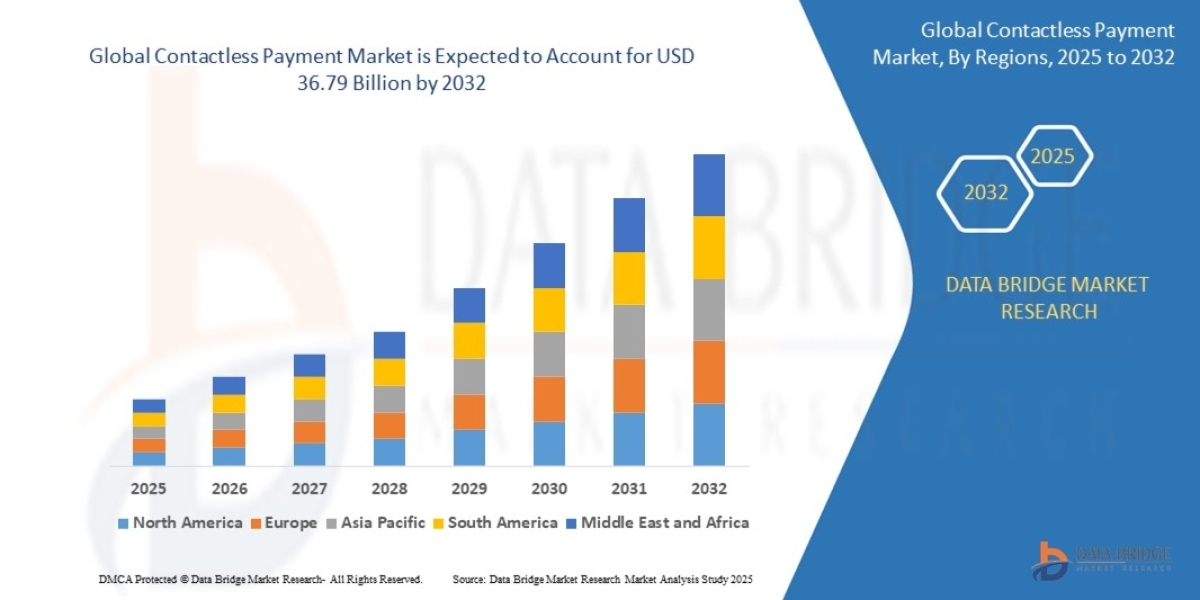

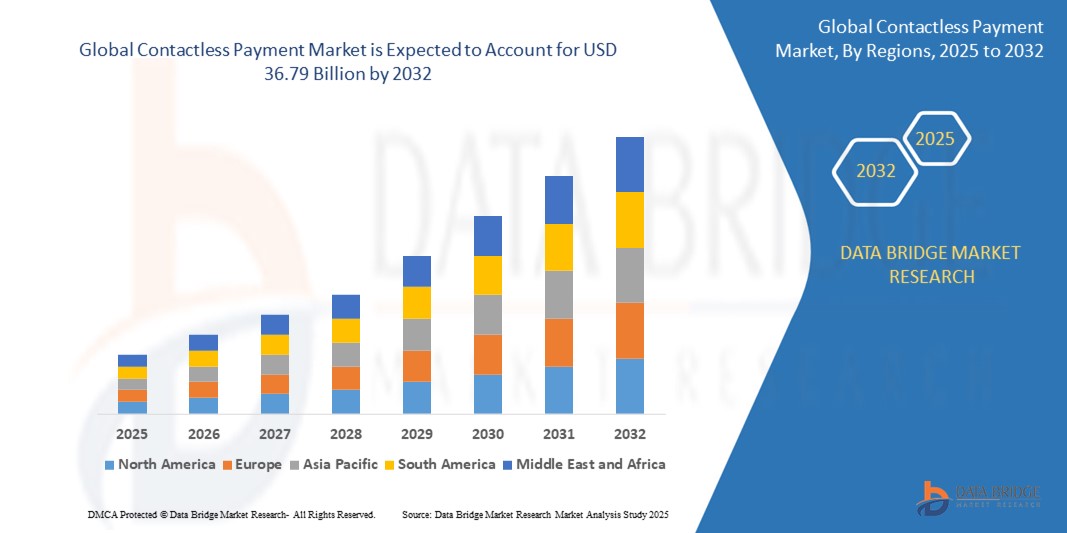

During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 11.20%, primarily driven by technology innovation

Contactless Payment Market research report comprises of fundamental, secondary and advanced information related to the global status and trend, market size, sales volume, market share, growth, future trends analysis, segment and forecasts. Market drivers, market restraints, opportunities and challenges are studied under the topic of market overview, which gives valuable insights to businesses for taking right moves. Additionally, the high quality Contactless Payment Market report presents a profound overview of product specification, technology, product type and production analysis by taking into account most important factors such as revenue, cost, and gross margin.

The large scale Contactless Payment Market report showcases important product developments and tracks recent acquisitions, mergers and research in the Contactless Payment Market industry by the key players. The report also takes into consideration the detailed profiles of market’s major manufacturers and importers who are dominating the market. The report comprises of all the market shares and approaches of the major competitors or the key players in the Contactless Payment Market industry. Besides, this report endows with an exhaustive study for the present and upcoming opportunities in the market which brings into light the future investment in the market. So, to achieve competitive advantage and to succeed in the market, Contactless Payment Market research report is the perfect solution.

Review comprehensive data and projections in our Contactless Payment Market report. Download now:

https://www.databridgemarketresearch.com/reports/global-contactless-payment-market

Contactless Payment Market Growth Snapshot

**Segments**

- **By Component:**

The contactless payment market can be segmented based on components such as hardware, software, and services. The hardware segment includes contactless readers, PoS terminals, NFC chips, and others. Software comprises mobile apps, payment gateways, and security solutions. Services involve consulting, integration, and maintenance services to support the system's smooth functioning.

- **By Technology:**

Segmentation by technology includes RFID, NFC, QR codes, and host card emulation (HCE). Radio-frequency identification (RFID) technology is widely used in contactless payments for tracking and identifying objects. Near-field communication (NFC) enables seamless communication between devices for transactions. QR codes are gaining popularity due to their ease of use, while host card emulation (HCE) allows secure transactions through virtual representation of payment cards.

- **By Payment Mode:**

The market can also be segmented by payment mode, such as mobile devices, smart cards, and wearable devices. Mobile devices like smartphones and smartwatches are increasingly becoming the preferred choice for contactless payments due to their convenience and accessibility. Smart cards, including credit and debit cards embedded with NFC technology, are widely used for tap-and-go payments. Wearable devices like smart wristbands and rings are emerging as convenient payment modes for users.

**Market Players**

- **Visa Inc.:**

One of the key players in the global contactless payment market, Visa offers secure and convenient payment solutions through its contactless cards and digital wallets. With a wide network of merchants and financial institutions, Visa plays a significant role in promoting contactless payments worldwide.

- **Mastercard Incorporated:**

Mastercard is another prominent player providing contactless payment solutions to consumers and businesses. Its innovative technologies, such as Masterpass and PayPass, enable fast and secure transactions using contactless technology. Mastercard's collaborations with various partners further drive the adoption of contactless payments.

- **Apple Inc.:**

Apple is a frontrunner in the contactless payment market with its Apple Pay service, which allows users to make secure payments using their Apple devices. By integrating NFC technology and biometric authentication, Apple ensures a seamless and secure payment experience for its customers. The company's emphasis on privacy and security has contributed to the widespread acceptance of Apple Pay globally.

- **Samsung Electronics Co., Ltd.:**

Samsung offers its contactless payment solution, Samsung Pay, to users across multiple countries. With support for MST (Magnetic Secure Transmission) and NFC technologies, Samsung Pay offers versatility in payment options. Samsung's strategic partnerships with banks and merchants enhance the accessibility of contactless payments for its customers.

The global contactless payment market is witnessing significant growth driven by the increasing adoption of digital payment solutions, advancements in technology, and changing consumer preferences towards convenient and secure payment methods. As the market continues to evolve, key players like Visa, Mastercard, Apple, and Samsung are expected to play a crucial role in shaping the future of contactless payments.

The global contactless payment market has been experiencing a rapid evolution driven by various factors such as technological advancements, changing consumer behavior, and the need for convenient, secure payment methods. One of the key trends shaping the market is the increasing integration of contactless payment technology across various industries. Retail, healthcare, transportation, and hospitality sectors are adopting contactless payment solutions to enhance customer experience and streamline transactions. This trend is expected to fuel the growth of the contactless payment market in the coming years as more businesses realize the benefits of adopting contactless payment options.

Another significant trend in the market is the rise of mobile-based contactless payment solutions. With the proliferation of smartphones and the increasing popularity of mobile wallets, consumers are gravitating towards using their mobile devices for contactless payments. This trend is driving innovation among market players to develop user-friendly, secure mobile payment applications that cater to the needs of tech-savvy consumers.

Moreover, the emphasis on security and fraud prevention in contactless payments remains a critical concern for both consumers and businesses. Market players are continuously enhancing security features such as tokenization, encryption, and biometric authentication to protect sensitive payment data and build trust among users. As the contactless payment market continues to expand, ensuring robust security measures will be crucial to maintaining consumer confidence and driving further adoption of contactless payment solutions.

The competitive landscape of the global contactless payment market is characterized by intense rivalry among key players such as Visa, Mastercard, Apple, and Samsung. These players are investing heavily in research and development to innovate and introduce new features that enhance the user experience and differentiate their offerings in the market. Strategic partnerships with financial institutions, merchants, and technology providers are also instrumental in expanding market reach and capturing new opportunities in the evolving payment ecosystem.

Looking ahead, the contactless payment market is poised for continued growth, driven by factors such as increasing smartphone penetration, regulatory support for digital payments, and the growing preference for touchless transactions in a post-pandemic world. As market players continue to invest in technology and partnerships to drive innovation and address evolving consumer needs, the contactless payment market is expected to witness sustained expansion and transformation in the years to come.The global contactless payment market continues to experience growth and evolution, driven by various factors that are shaping the industry landscape. One emerging trend in the market is the integration of contactless payment technology across diverse sectors beyond traditional retail and finance. Industries such as healthcare, transportation, and hospitality are increasingly adopting contactless payment solutions to improve customer experience, enhance operational efficiency, and streamline transactions. This trend signifies a growing acceptance and utilization of contactless payments as a versatile solution applicable across multiple sectors, expanding the market's potential reach and impact.

Moreover, the surge in mobile-based contactless payment solutions is significantly influencing market dynamics. With the widespread adoption of smartphones and mobile wallets, consumers are increasingly opting for mobile devices as their preferred means of conducting contactless transactions. As a result, market players are focusing on developing user-friendly, secure mobile payment applications that cater to the demands of tech-savvy consumers. This trend reflects a shift towards mobile-centric payment methods, highlighting the importance of innovating mobile payment solutions to meet consumer expectations and preferences.

Furthermore, the emphasis on security and fraud prevention in contactless payments remains a critical concern driving market developments. To address these challenges, industry players are continuously enhancing security measures by implementing advanced technologies such as tokenization, encryption, and biometric authentication to safeguard sensitive payment information. By prioritizing security features and building consumer trust, market participants are strengthening the foundation for broader adoption of contactless payment solutions, reinforcing the market's resilience and sustainability in the face of evolving security threats.

Additionally, the competitive landscape of the global contactless payment market is characterized by intense competition among key players striving to differentiate their offerings through innovation and strategic partnerships. Companies like Visa, Mastercard, Apple, and Samsung are actively investing in research and development initiatives to introduce new features that enhance user experience and drive market differentiation. By forging partnerships with financial institutions, merchants, and technology providers, these industry leaders are expanding their market presence and leveraging collaborative opportunities to capitalize on the evolving payment ecosystem.

In conclusion, the contactless payment market's trajectory is poised for continued expansion and transformation, fueled by factors such as increasing smartphone penetration, regulatory support for digital payments, and the growing demand for touchless transactions in a post-pandemic era. As market players navigate these trends and challenges, the focus on innovation, security, and strategic partnerships will be instrumental in driving sustainable growth, fostering consumer trust, and unlocking new opportunities in the dynamic landscape of contactless payments.

Get a closer look at the company’s market penetration

https://www.databridgemarketresearch.com/reports/global-contactless-payment-market/companies

Global Contactless Payment Market – Segmentation & Forecast Question Templates

- What is the financial scale of the Contactless Payment Market today?

- What growth rate is the market heading toward?

- How is the Contactless Payment Market segmented in this analysis?

- Which brands or entities are Contactless Payment Market leaders?

- What have been the top recent product introductions?

- Which individual countries are profiled in the study?

- Where is the speediest growth happening by region?

- Who will likely top the market leaderboard by country?

- What region comprises the largest piece of Contactless Payment Market share?

- Where is the strongest CAGR growth expected geographically?

Browse More Reports:

Singapore Geotechnical Instrumentation - Monitoring Market

Global Hyaluronic Acid Market

Global Nasal Spray Packaging Component Market

Global Nitrocellulose Market

Global Albinism Drug Market

Middle East and Africa Self-leveling Concrete Market

North America Enzyme Immunoassay (EIA) Reagents and Devices Market

Global Krill Fishery Market

Global Anal Cancer Drug Market

Global Telecom Billing Outsourcing Market

Middle East and Africa Herpes Market

Global N-Acetyl-L-Tyrosine Market

Global Middle Ear Implants Market

Global Grease Market

Global Solid State Drive Market

Global Liquorice Extracts Market

Global Acidifiers Market

Global Security Operations Center (SOC) as a Service Market

Global Emphysema Market

North America Self-leveling Concrete Market

Global Construction Composites Market

Global Thin Wall Plastic Container Market

Global Laryngeal Masks Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"